Building wealth isn’t only about earning more. It’s about making smart, consistent decisions with the money you already have. These habits may look simple at first, but they shape a strong financial foundation that grows over time.

1. Pay Yourself First — Before Paying Anyone Else

Most people save whatever is left after expenses, which usually means nothing. The real smart move is to save first and spend later.

Set an automatic transfer of at least 20% of your income into a savings or investment account the moment your salary arrives.

This habit forces discipline and builds financial security without thinking too much. It also prepares you for emergencies and avoids unnecessary stress.

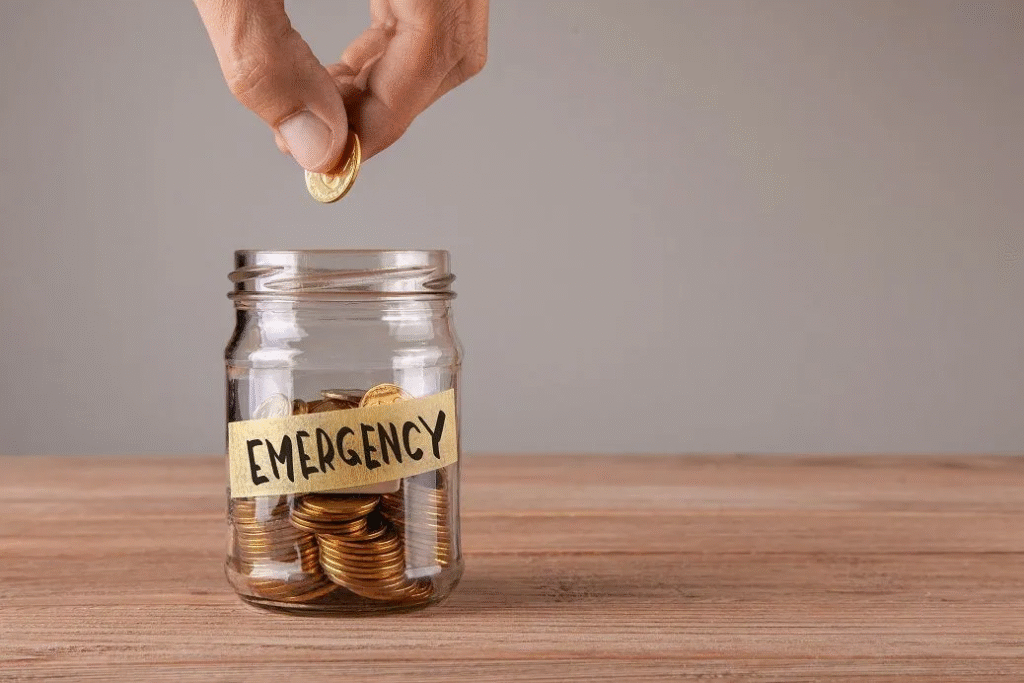

2. Build a 6-Month Emergency Fund

Life is unpredictable. Job loss, medical emergencies, or sudden expenses can put your finances at risk.

Creating a 6-month emergency fund helps you avoid loans or credit card debt when something unexpected happens.

Start with a small goal like ₹10,000, then ₹25,000, and slowly build it up. Keep this money in a liquid fund, high-yield savings account, or FD, so it’s easily accessible but not spent casually.

3. Invest Consistently, Not Randomly

Investing once in a while doesn’t create wealth. Investing every month does.

Whether it’s SIP in mutual funds, blue-chip stocks, index funds, or digital gold, small regular amounts grow massively with compounding.

Even ₹1,000 invested monthly can grow into lakhs over the years. The key is consistency, not perfection.

Research basic risk levels and diversify your portfolio instead of betting everything on a single investment.

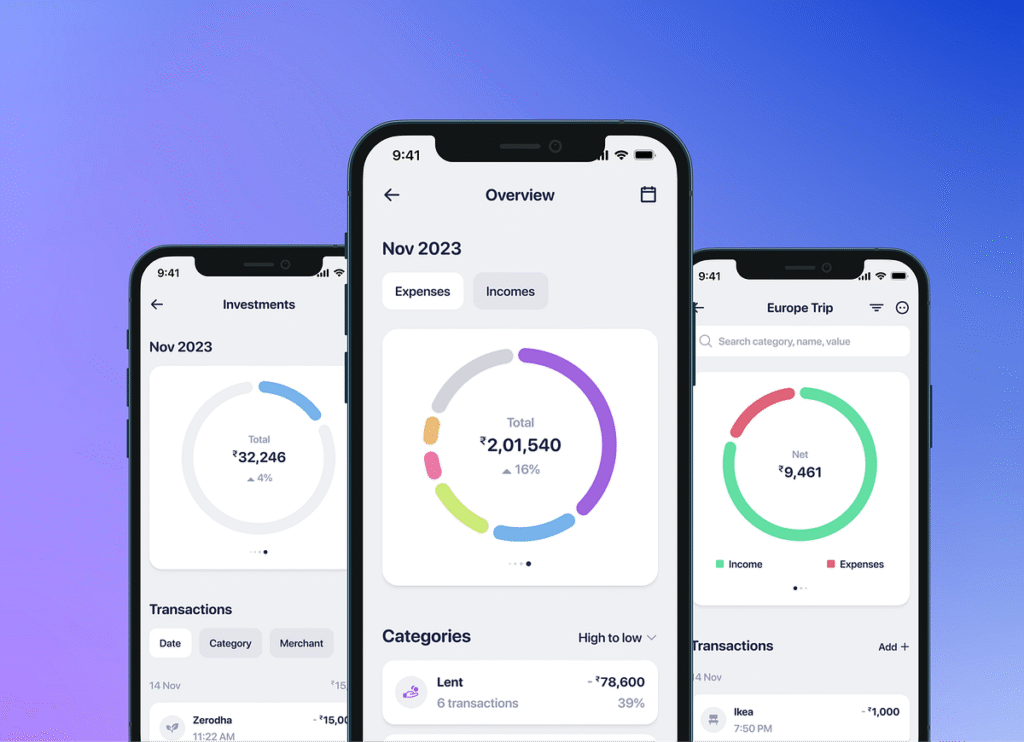

4. Track Every Rupee You Spend

You can’t fix what you don’t measure.

People often overspend without realizing where the money goes.

Use tools like Walnut, Money Manager, Notion, or even a simple Google Sheet to track expenses.

Once you know your spending pattern, it becomes easier to cut unnecessary costs and divert them towards savings or investments.

5. Avoid High-Interest Debt at Any Cost

Credit card bills, personal loans, and payday loans can trap you for years.

High-interest debt eats your future income before you even earn it.

Your first goal should be to clear off such debt completely.

If you already have debt, use the snowball method (clear the smallest loan first) or the avalanche method (clear the highest interest loan first).

6. Live Below Your Means — Not Your Desires

Being rich doesn’t come from showing off; it comes from smart decisions.

Start by controlling lifestyle inflation.

Just because your income increases doesn’t mean your expenses should too.

Buy things you need, not things you want just to impress others.

This simple habit accelerates wealth growth because you save and invest more without feeling stressed.

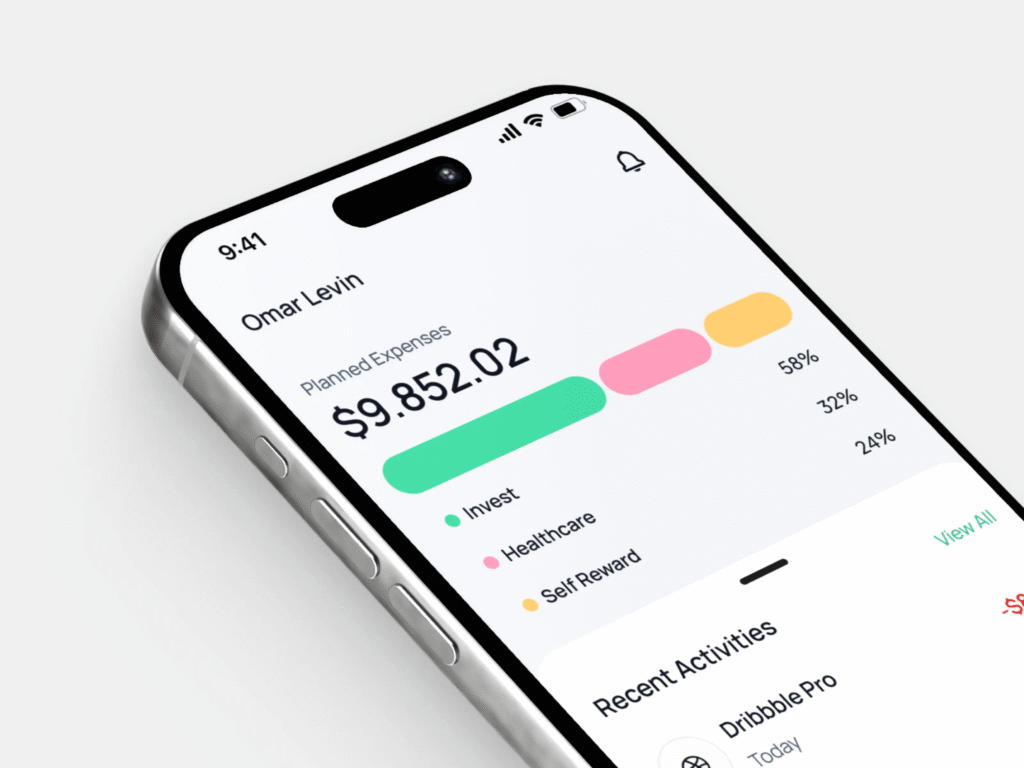

7. Set Clear Financial Goals and Timelines

You save better when you know what you’re saving for.

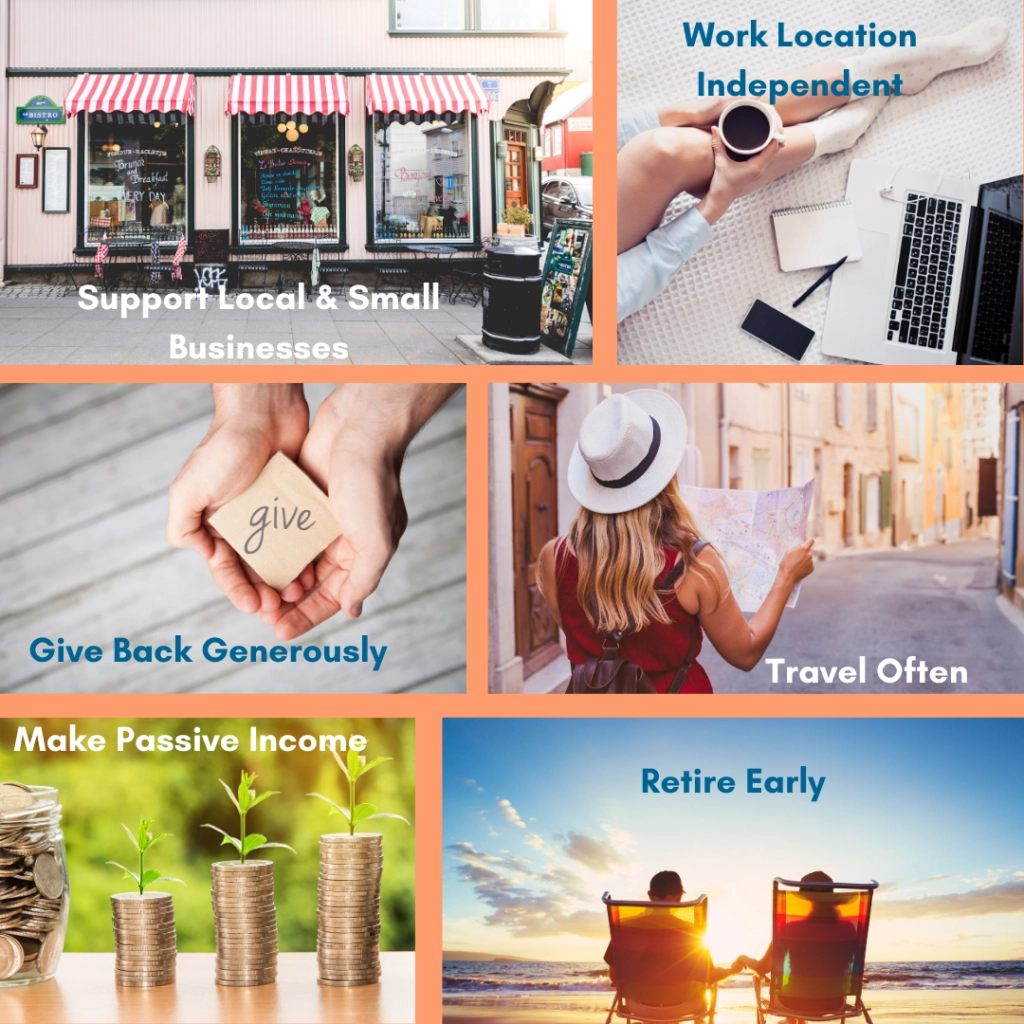

Your goals could be:

- Buying a house

- Starting a business

- Traveling abroad

- Retirement planning

- Building a dream lifestyle

Create short-term goals (1 year), mid-term goals (1–5 years), and long-term goals (10+ years).

This helps you choose the right investments and stay motivated.

8. Learn About Money Regularly

Financial literacy is the biggest wealth-building tool.

You don’t need to be an expert, but understanding the basics of:

- inflation

- interest

- credit score

- taxes

- investments

- budgeting

…helps you make better decisions than 80% of people.

Read financial books, follow trusted YouTube channels, and listen to podcasts that simplify money.

9. Build Multiple Streams of Income

Relying on a single salary can be risky and limiting.

Start creating side income sources like:

- Freelancing

- Blogging

- Affiliate marketing

- Part-time online work

- Investing for dividends

- Selling digital products

- Small home business

Even ₹5,000 extra every month adds up and boosts financial strength.

10. Protect Your Wealth with Insurance

Many people ignore insurance thinking it’s unnecessary.

But one medical emergency can destroy savings built over years.

Always have:

- Health insurance

- Term life insurance

- Optional add-ons like critical illness

Insurance saves you from massive financial loss and keeps your wealth safe.

Smart money moves aren’t shortcuts. They are long-term habits that build a strong financial life.

Once you start applying them consistently, you’ll notice less stress, better control, and steady financial growth.

This content is for educational purposes only. Investments and financial decisions carry risks, so always research or consult a certified financial advisor before making major decisions.

#SmartMoneyMoves #WealthBuilding #FinancialFreedom #Carrerbook #Anslation #MoneyManagement #PersonalFinance #InvestWisely #RichMindset #SavingsGoals #FinancialPlanning